How Do You Mine?

Firstly, you’re going to need to pick a coin. This decision alone can be pretty daunting; a look at coinmarketcap.com, which lists cryptocurrencies by market cap (value multiplied by coins in circulation), reveals well over 1,000 coins with a combined market value of $255 billion at the time of writing, the top three being Bitcoin with a massive 45 percent share, followed by Ethereum and Ripple. Detailing the differences between them and other coins is not within this article’s scope, so additional research will be required, but the majority of miners using graphics hardware are (currently) focused on Ethereum.

However, many also choose to accumulate small “alt-coins” in the hope that their value will one day escalate a la Bitcoin. This is certainly a possibility, but you would be wise to be very wary, as many cryptocurrencies are created to exploit this very hope – you needn’t look far to find victims of get-rich-quick scams, pyramid schemes, and coins created solely to make their creators richer. Again, this is a highly unregulated market right now, so treat it with due diligence. Both the losses and gains are potentially very high, but if you don’t know what you’re doing chances are you are going to lose and be eagerly exploited by someone who does.

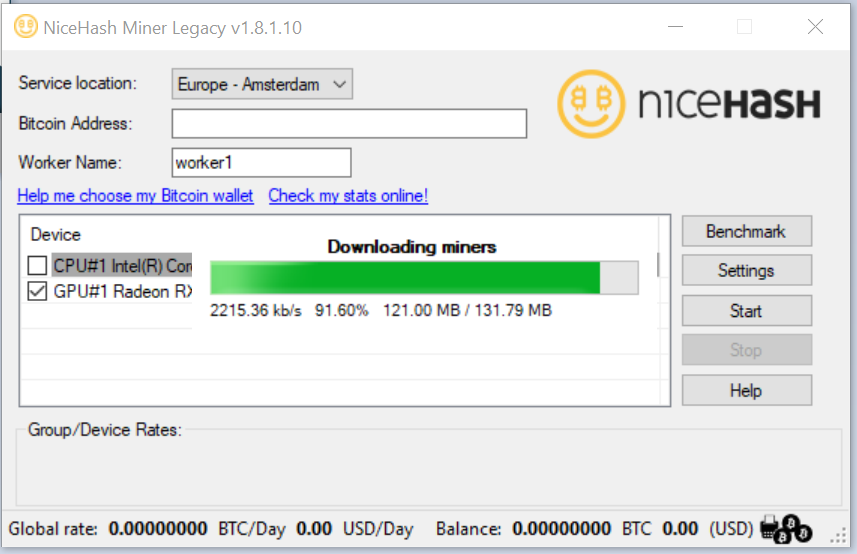

The Easy Way: NiceHash

The days of mining Bitcoin at home are over; the complexity of doing so now means this is pretty much the sole domain of industrial-scale mining operations (literally warehouses packed with dedicated ASICs). Nevertheless, one easy way to trade computing power for a slither of the sizeable Bitcoin pie is through NiceHash, a marketplace where sellers literally exchange their computing power for Bitcoin. Said power can be used to mine whatever the buyer fancies, and it’s all tied up with an easy-to-use GUI including benchmarks that let you determine an average payout for the hash rate you’re able to contribute to a given algorithm. You simply select the most profitable one, tell it where to direct your funds in the Bitcoin Address form, and let the software and the marketplace handle the rest. The latest version limits support to Nvidia cards, but AMD users can easily use NiceHash Legacy, which is the one shown below.

NiceHash takes its cut, of course, but the ease-of-use is a real highlight. Bitcoins can be paid directly into your own ‘external’ wallet (less regular payouts and pretty steep fees) or into a NiceHash-managed ‘internal’ wallet (quicker payouts and lower fees) where they can later be extracted. As ever, coins are not truly yours until they are in a wallet that you directly own, and NiceHash has indeed suffered a pretty massive hack in the past, but to its credit it is continuing to repay affected users in waves through a reimbursement program. It can also be subjected to buyers manipulating the price of hash rates, which could affect your payout.

Do It Yourself: Mine Ethereum with Claymore

Alternatively, you can mine a coin directly yourself. This requires a bit of extra faff, and there’s no single set-in-stone way to do it, but it gives you better control, comes with fewer risks, and has less exposure to third-party fees.

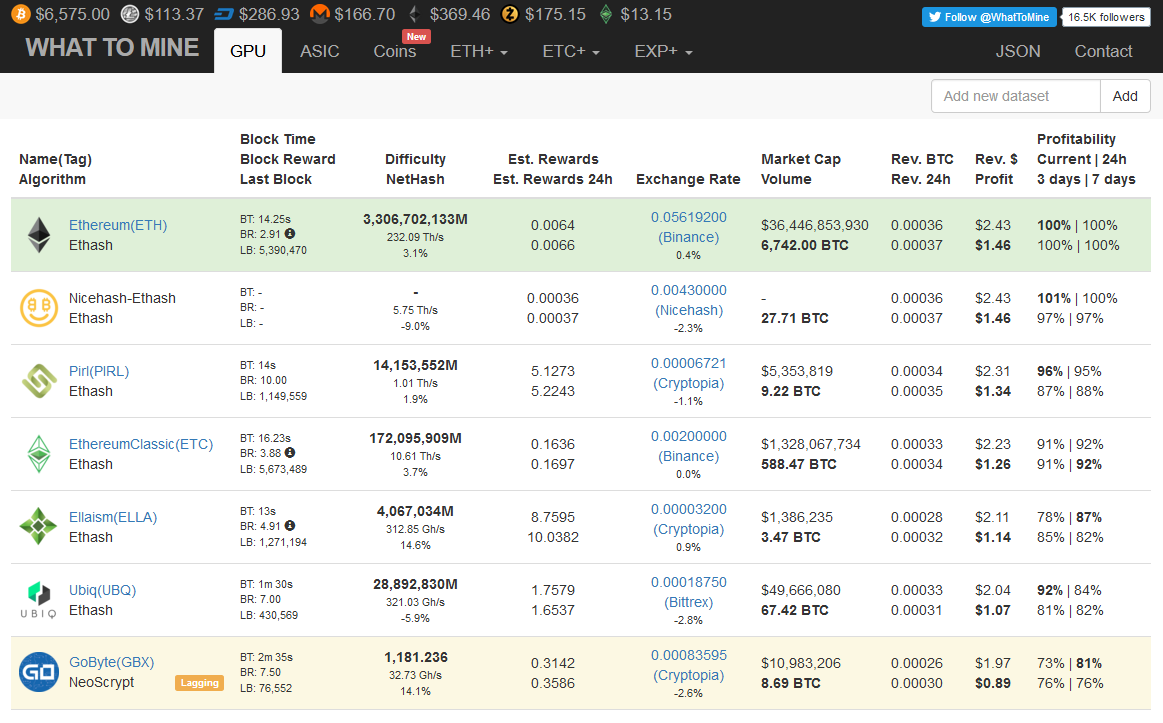

The handy website whattomine.com is a great tool to help you decide what’s most likely to be of use to you. You can tell it what hardware you have and how much your electricity costs, and it outputs the most profitable coins. Our focus is going to be Ethereum for demonstration purposes, since this is most likely what you’ll pick with graphics cards currently, but the approach is generally applicable.

Firstly, you will need a wallet into which earnings will be paid. As discussed, a wallet has two keys, the public key which anyone can see and to which funds can be sent, and a private key, the password used to unlock said funds and verify that it’s you sending them. If your private key is compromised, so are your funds. You can have wallets managed by exchanges like Coinbase, web-generated wallets like MyEtherWallet, desktop wallets like Mist (the official Ethereum one), or even hardware wallets, literally portable USB-connected devices for offline storage and maximum security. Each of these trades usability and security (and cost for hardware wallets) to varying degrees, so research is definitely recommended.

Next, you’ll need to join a mining pool. This is necessary as only large computational pools have a significant chance of solving any one block, at which point you’re rewarded based on the proportion of work you contributed. We’ll use Ethermine as our example, but again others are available.

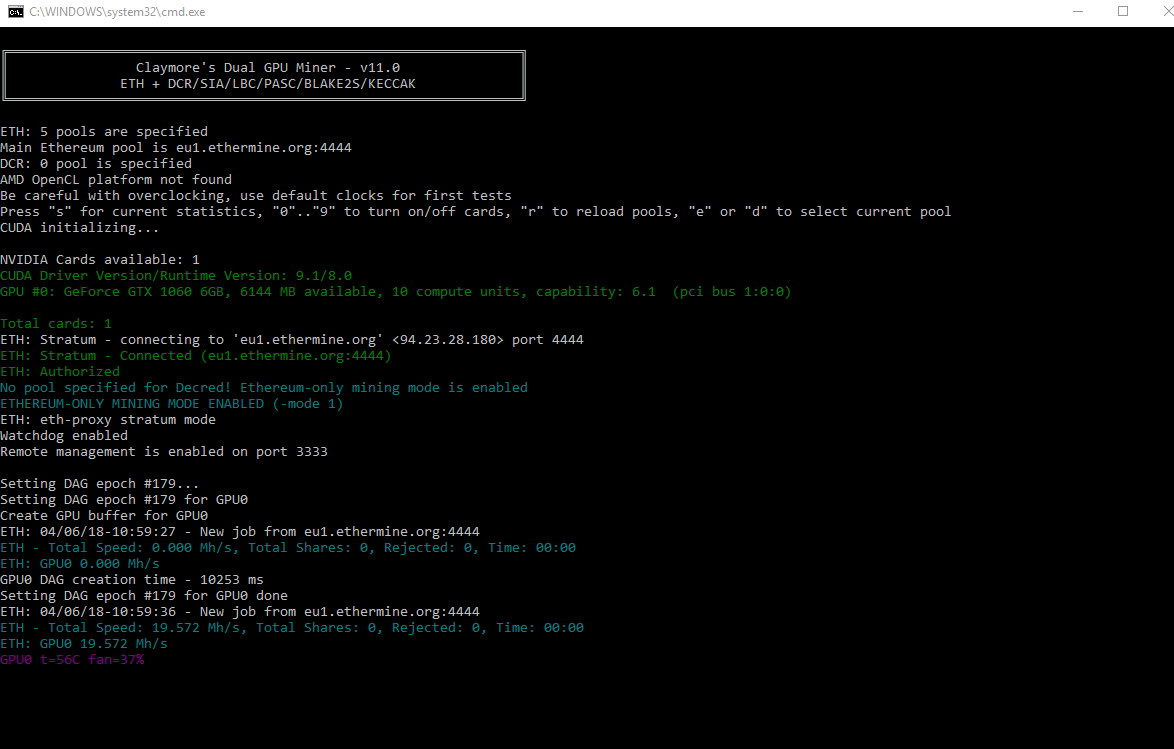

Finally, you need to run some mining software to actually do the work. For Ethereum, Claymore is recommended as the quickest and easiest to use. You can find download links for Windows and Linux for both AMD and Nvidia hardware on the Ethermine website, and these will be preconfigured to contribute to the Ethermine pool; you just need to change the wallet address to match yours. To do this, right-click and edit the ‘start.bat’ file in the Claymore directory. The address you need to replace with your own is highlighted in the below text.

EthDcrMiner64.exe -epool eu1.ethermine.org:4444 -ewal 0xD69af2A796A737A103F12d2f0BCC563a13900E6F -epsw x -dpool stratum+tcp://dcr.suprnova.cc:3252 -dwal Redhex.my -dpsw x

Everything in red can also be deleted, as the default configuration tells Claymore to mine two coins at once, in this case -dpool means it’s set up to mine Decred, but our focus for simplicity is purely Ethereum.

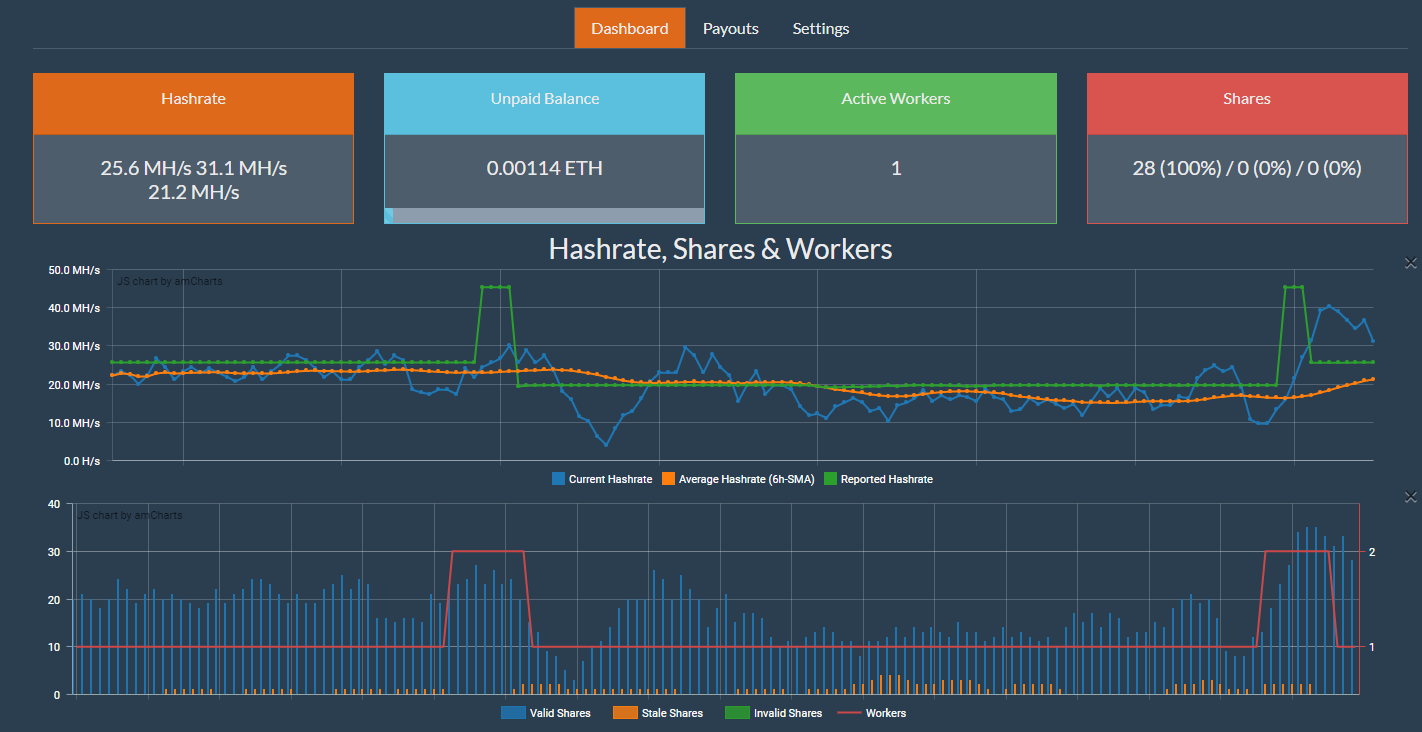

Run the newly edited 'start.bat' file, and that’s it! You’re now mining Ethereum. If everything is working as it should be, search for your wallet address on Ethermine, and you’ll get a screen similar to below where you can manage your payouts, track your hash rate, and so on.

If you want to go further down the rabbit hole, you can delve deep into the world of custom BIOS profiles and overclock settings in order to optimise your hash rate to power consumption ratio. Forum and Reddit discussion threads with such information are not hard to come by.

Withdrawing Cryptocurrency into Pounds (Also: Tax)

This is well worth a small section, as it's actually not the easiest thing to do. Once you've accumulated a cryptocurrency, actually turning it into pounds can be a challenge unless you personally know someone willing to do a private exchange. Probably the best way currently is to use Coinbase, although even then you have to go through the European banking system, and this will impact on your profits compared to a pure conversion. Revolut is another option as well.

There are also various tax issues to be aware of; most advice tends to be to keep good records of your cryptocurrency, since there is actually no clear guidance from the UK government. Of course, money laundering is quite explicitly tied to cryptocurrencies, but we'll steer clear of that particular minefield.

Head over the page for a few quick tests with NiceHash and Claymore assessing the potential profitability of current-generation cards.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.